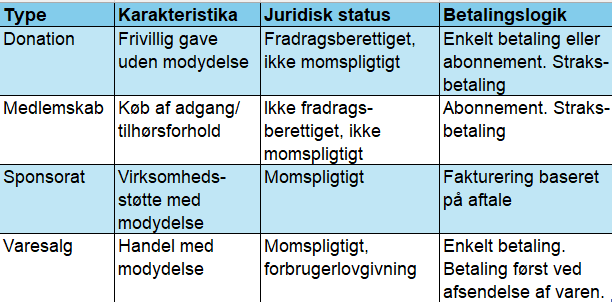

Why should memberships, donations, sponsorships and merchandise sales be treated differently?

When the basis for a §8A approval is a combination of memberships and donations, most organizations will need forms to capture these two. In addition, sponsorships are often added and sometimes merchandise sales. But can you use one form for everything, or should you split it up?

Our recommendation is that you always use different forms and landing pages for the four types of forms – memberships, donations, sponsorships and merchandise sales. Not only because the offer, communication and donor journey are all different, but also because it is legally and practically better to keep them separate.

Are you unsure about the legal differences?

Find help at ISOBRO

Let’s take a closer look at the four types.

Donations

Donations are voluntary gifts given without remuneration. This means that the donor does not receive any specific product, service or membership benefit in return.

It is of course okay to show appreciatoin for the donation, but it must not appear as payment for a product or service.

Donations may only be requested publicly if the organization has a fundraising permit from the Danish Fundraising Board.

Tax conditions

Donors can get a tax-deduction for donations up to a total amount of DKK 17,900 per person (2025). The organization has a reporting obligation to SKAT and must therefore register the donor’s CPR number in order to be able to report correctly.

This means that forms created in OnlineFundraising must be marked as deductible. Then the donation will be included in the specific report that can be made to SKAT.

Accounting

the Danish Fundraising Board requires that donations be handled separately from other incomes, or that each payment type and any earmarking can be documented in detail. This does not mean that they must appear in a separate account.

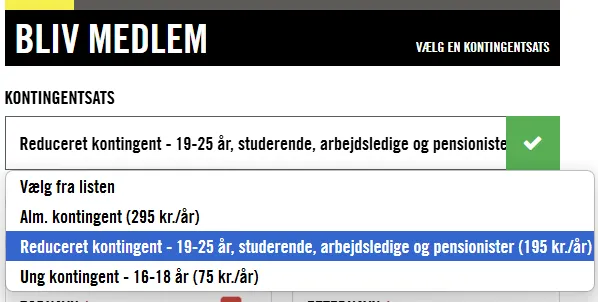

Membership

A membership implies that you obtain a right or access – for example, the right to participate in the general meeting, receive member information or access to member discounts.

The fee for a membership must be determined in advance and linked to the remuneration that the membership gives access to. The membership and any changes to the price must be described in the statutes of the association.

Tax conditions

There is no tax deduction for the membership fee unless the organization is approved under special rules.

It is permissible to ask about memberships unsolicited without prior consent, as memberships are exempt from the consent requirement of the Danish Marketing Act.

Note that a person can be both a donor and a member, but only the donation is tax deductible – not the membership.

Legally

To obtain (and maintain) §8A approval, the association must have at least 300 paying members. The same members must also be able to be summoned to general meetings. Therefore, it is also necessary to have very clear marking of who is a member and of what type.

Sponsorships (business donations)

Smaller business donations can be handled as private donations, but when companies make larger contributions – often over DKK 5,000-10,000 – many choose to enter into a sponsorship agreement instead.

A sponsorship is considered a remuneration for tax purposes because the company receives a specific benefit, for example exposure, advertising or access to networks. Therefore, VAT must be added and the sponsorship is treated as ordinary revenue in the accounts.

For the company, this is rarely a problem, as the VAT can be deducted and the sponsorship can be booked as an operating expense. For many companies, this can be more advantageous than making a donation, which must be deducted after tax.

Payment

Sponsorships are typically invoiced with VAT and based on a signed cooperation agreement.

Merchandise sales

Merchandise sales differ significantly from donations, memberships and sponsorships, as they are a pure commercial transaction. The organization offers a product or service that the customer buys at a set price.

The important thing is that you will be able to buy a similar item in a regular store (or webshop) for a roughly similar price. For the item to fall into the donation category, there must be a significant difference between the price/donation and the item.

An example could be a fixed grant of 300 DKK/month, where you get a tote bag when you sign up. On the other hand, a t-shirt for 250 DKK would not be considered a donation. Here, other rules would come into play, such as the money only being withdrawn when the item is shipped!

Legal and tax conditions

- Merchandise sales are covered by the consumer legislation, which means that the buyer has the right to complain and the right to cancel the purchase in certain cases.

- The organization must meet the requirements of the Marketing Practices Act, including clearly informing about price, delivery and terms. This also applies to communication about the product – both before and after purchase.

- Merchandise sales are subject to VAT, and the organization must charge and settle VAT correctly.

- If the merchandise sale takes place online, the rules on online selling and GDPR also apply when customer data is processed.

Summary

Evidently there is a big difference in the purposes and requirements for the different types of contributions that exist in connection with charitable purposes.

Our clear recommendation is to not mix multiple purposes in the same form, but to separate them.